- Introduction

- How do Dutch covered bonds work?

- Covered bond company

- Collateral

- Repayment

- Dutch Central Bank registration

- UCITS and CRD compliance

Introduction

Although the history of covered bonds in the Netherlands goes back centuries, it is commonly accepted that the first modern covered bond was issued by ABN AMRO Bank in 2005. These first Dutch covered bonds were based on the concept of contractual covered bonds, a concept that was introduced by UK issuers in 2003. However, in 2008 new covered bond regulation was introduced in the Netherlands with the aim of creating a transparent covered bond market that would offer a high degree of security to investors. As of that date, Dutch banks can issue law-based, regulated covered bonds. Currently, covered bonds issued by ABN AMRO Bank, ING Bank, NIBC Bank and SNS Bank are law-based, regulated covered bonds.

How do Dutch covered bonds work?

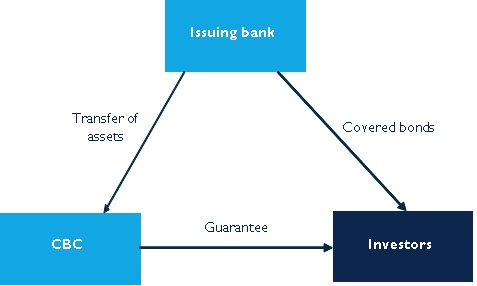

The strength of any covered bond lies in the principle of dual recourse. First, the holder of a covered bond turns to the issuer of the covered bond for payment of interest and repayment of principal. In case of an issuer default, the investor can rely on a pool of collateral, held by the covered bond company. This special purpose vehicle is there solely for the benefit of the covered bond note holders as it segregates the covered bond collateral from the issuing bank. The dual recourse provides a large degree of security to investors, which is reflected in the ratings of covered bonds. These ratings are typically higher than those of the issuing bank.

Covered bond company

All Dutch covered bond programmes incorporate a covered bond company (CBC). This special purpose vehicle holds the mortgage collateral for the benefit of the covered bond investors. When a bank issues a covered bond it needs to transfer sufficient collateral to the CBC. The transfer of collateral is done under a guarantee support agreement. This provides the legal basis for the delivery of the collateral to the CBC. The actual delivery of mortgages is done in the form of assignment to the CBC. Should the issuing bank default, the CBC will step in and make the scheduled payments of interest and principal. In the event that the CBC can no longer meet the scheduled payments of interest and principal, the collateral assets will be sold to pay interest and redeem all outstanding covered bonds.

The basic principle of Dutch covered bonds can be visualized as set out in the figure below.:

Collateral

For the principle of dual recourse to work, the covered bond company at all times needs to hold sufficient collateral in relation to the outstanding covered bonds. To date, Dutch covered bond programmes are backed by prime Dutch residential mortgages. In addition, some allowances are made for substitution assets. Substitution assets include cash and other assets eligible under the Capital Requirements Directive (CRD) to collateralize covered bonds. Substitution assets are subject to minimum rating and maximum percentage requirements, which can vary between programmes. Dutch covered bond programmes also allow for inclusion of non-Dutch residential mortgages, subject to certain restrictions. Currently, only NIBC Bank's soft bullet programme has a mixed pool of prime Dutch and German residential mortgages. Collateral pools for Dutch covered bonds are dynamic and can be substituted at any point, subject to certain restrictions.

Every issuer has to make sure that the covered bond company holds sufficient collateral in relation to the outstanding covered bonds. This is done through the asset cover test, which is checked by an independent asset monitor. Usually, a large accounting firm is appointed for this role. All Dutch programmes have a certain level of overcollateralization, as stipulated in their respective documentation.

- hard bullet,

- soft bullet

- conditional pass through.

In a soft bullet scenario the collateral has to be liquidated and the bonds mustcan be repaid within an extension period of 12 (or in the case of NIBC’s soft bullet programme 18) months after the scheduled maturity date.

The last possibility is the conditional pass through covered bond (CPTCB). The bonds will be redeemed whenthe fact whether the proceeds of the liquidation of the collateral pool are sufficient to redeem the bonds at par.

Dutch Central Bank registration

Following the introduction of new covered bond regulation in 2008, the Dutch Central Bank (DNB) set up a registration system for covered bond issuers. The registration is designed to provide further transparency on Dutch covered bonds and give investors even more comfort on the product. Dutch banks can only issue law-based, regulated covered bonds if they have registered their covered bond programme with the Dutch Central Bank. To obtain such registration, banks must meet the following requirements:

- the issuing bank must comply with the general covered bond regulation in the Netherlands, as established in 2008;

- the covered bonds, at issuance, must have a credit rating of at least AA- or Aa3;

- there must be a healthy ratio between the amount of segregated covered bond collateral and the assets that remain freely available on the balance sheet of the issuing bank. This is to protect other stakeholders, such as holders of unsecured bank debt;

- the issuing bank must demonstrate that it has in place adequate procedures for monitoring and verifying the required amount of collateral in relation to the outstanding covered bonds. These procedures must also include risk assessments and stress tests.

Once a bank has obtained DNB registration, it is subject to various ongoing administration and reporting obligations. More information on Dutch covered bond supervision can be obtained via the website of DNB.

UCITS and CRD compliance

Banks that have registered their covered bond programmes with DNB are able to issue law-based, regulated covered bonds. This means that these bonds are UCITS compliant. In addition to UCITS compliance, Dutch registered covered bond issuers have to be CRD compliant. In order to be CRD compliant, the loan-to-value cut-off percentage has to be set at a maximum of 80%. Any excess value of the loan serves as extra credit enhancement, thus providing even more comfort to investors.